Parametric insurance is a fast-evolving solution in the world of risk management and insurance, especially as climate change and unpredictable disasters grow in scale and frequency. Unlike traditional insurance, which compensates for actual losses incurred, parametric insurance pays out based on the occurrence of a specific event that meets pre-agreed parameters.

This innovative approach is changing how individuals, businesses, and governments prepare for and recover from risk. But how does it work, and is it right for you or your organization?

Let’s explore the basics, benefits, and real-world applications of parametric insurance.

Detailed Analysis: Understanding Parametric Insurance

How It Differs from Traditional Insurance

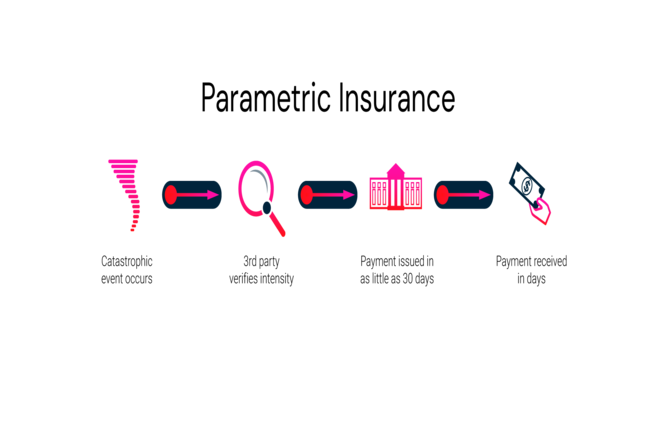

In traditional insurance, a loss must be evaluated, adjusted, and approved before a claim is paid. This can take weeks or months, and there may be disputes over how much should be covered.

Parametric insurance, on the other hand, works based on pre-defined triggers. These are measurable metrics like:

-

Wind speeds exceeding 120 km/h

-

Rainfall above 200 mm in 24 hours

-

An earthquake magnitude greater than 6.0

If the agreed-upon event happens and reaches the threshold, the policyholder automatically receives a fixed payout, regardless of the actual loss.

Key Elements of a Parametric Policy

-

Trigger Event: A clearly defined and measurable condition (e.g., rainfall, wind speed, seismic activity).

-

Threshold: The specific measurement that must be met or exceeded for a payout to occur.

-

Payout Amount: Pre-agreed compensation, which does not require a loss assessment.

Example: A farmer insures against drought. If rainfall in their region falls below 50 mm in 60 days, they automatically receive a payout, helping to offset crop losses—even if actual damages vary.

Historical Context: From Concept to Necessity

Parametric insurance gained traction in the early 2000s through weather-related risk coverage. Organizations like the Caribbean Catastrophe Risk Insurance Facility (CCRIF) pioneered its use to provide emergency funds after hurricanes and earthquakes, offering a lifeline to affected governments.

Today, it has expanded into agriculture, tourism, energy, and even event planning. As climate threats worsen and insurance gaps widen, parametric models are becoming more relevant across sectors and geographies.

Fan and Industry Reactions

Parametric insurance is widely praised for its speed and simplicity. Unlike traditional models, there is little room for disputes or delays. A 2023 report by Swiss Re shows growing adoption in Asia and Africa where access to conventional insurance is limited.

Small businesses and startups have begun exploring parametric solutions, especially those in event planning, agriculture, and clean energy. Platforms like Jumpstart Recovery and Arbol are leading examples, offering parametric coverage for earthquakes and climate risks, respectively.

Examples with Visuals

-

Agricultural Use: A vineyard in South Africa purchases parametric insurance that triggers if summer temperatures exceed 38°C for five consecutive days. This protects their grapes from heat-related damage and provides immediate funds for irrigation or crop loss recovery.

-

Event Insurance: A festival organizer in Florida secures parametric rain insurance. If rainfall exceeds 10 mm on the day of the event, they receive a payout—helping recover from ticket refund losses and vendor cancellations.

Advantages of Parametric Insurance

✔ Fast Payouts: Often within days

✔ Transparent & Objective: Based on third-party data (e.g., satellite, weather stations)

✔ No Loss Verification Needed

✔ Fills Coverage Gaps: Especially in disaster-prone or underserved regions

✔ Flexible & Scalable: Can be used by individuals, small businesses, or entire governments

Challenges and Limitations

-

Basis Risk: The payout may not exactly match the actual loss incurred.

-

Data Dependence: Accuracy hinges on reliable, up-to-date external data sources.

-

Complex Structuring: Designing an appropriate trigger and threshold can require technical expertise.

Despite these challenges, many view parametric insurance as a complement, not a replacement, for traditional coverage.

Also Check;

- Insurance Considerations When Starting a Family

- Microinsurance: Protection for Low-Income Households

- How Insurance Brokers Can Help You Save Money

- Top Questions to Ask Before Buying Health Insurance

- How Climate Change Is Affecting Insurance Policies

Conclusion or Final Thoughts

Parametric insurance offers a refreshing shift from reactive to proactive protection. As our world faces more frequent and severe natural disasters, the need for fast, reliable, and data-driven coverage is more urgent than ever.

Whether you’re a farmer, a coastal business owner, or a public policy planner, parametric insurance can provide the speed, transparency, and certainty that traditional policies often lack.

If you’re considering it, speak to a specialized broker or explore platforms like AXA Climate or Parametrix Insurance to learn more about structuring a policy tailored to your risks.